[w8_row margin_bottom=”30px”]

[w8_column type=”col-md-6″]« CII – A reference point for Indian Industry and the International business[/w8_column]

[w8_column type=”col-md-6″][/w8_column][/w8_row]

Engaging India! – September 3rd, 2015

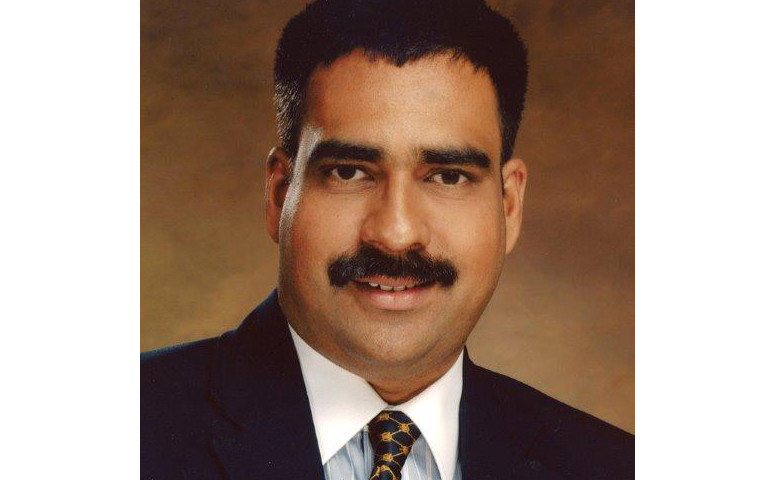

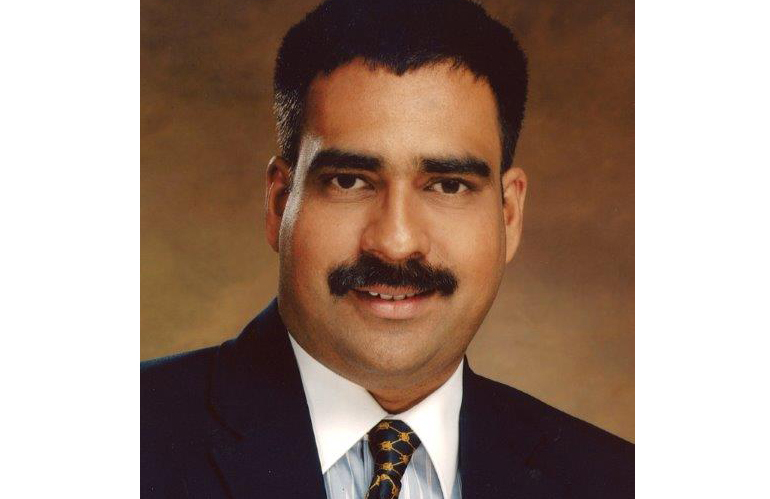

by Mr Sathish Raman, Director & Head, Confederation of Indian Industry (CII) South East Asia Regional office

Under Indian Prime Minister Narendra Modi, the last year has seen some notable changes in India. The Indian PM has been credited for bolstering India’s image and taking centre stage. Now, the reform agenda of the Government needs to help facilitate investments and lead economic growth. The attempt to create a corruption-free governance, empowerment of states and putting in place key policies to revive investment in the economy needs to be coupled with stronger measures for monitoring and implementation.

One year hence…

The CII President Mr Sumit Mazumder stated that in the last one year, inflation has declined, fiscal consolidation is better than targeted, current account deficit stands compressed, and the exchange rate graph has smoothened out. This provides a huge boost to consumer and investor confidence in the economic management of the country. Having strengthened the environment for doing business, the Government is acting rapidly on the reforms front, targeting multiple areas for investment and social development simultaneously. The opening of 120 million bank accounts at short notice or the building of 400,000 toilets in schools in one year are a testimony of the Government’s hard push for reforms.

The Make in India campaign is a multi-dimensional endeavor to boost manufacturing, targeting skill development, FDI, R&D, and most significantly, ease of doing business. In addition, Clean India initiative, Smart City projects, Digital India, Clean Energy, etc have set high targets and progressing as expected. The world’s eyes are on India at this moment, and Government and industry together can meet the expectations for fast growth.

Challenges still remain. Key reforms like implementation of the subsidy disbursal through direct benefit transfer using technology, disinvestment of government linked companies, plan to introduce GST and policy issues relating to land acquisition, infrastructure, energy, manufacturing, mining, labour, skill development, taxation and financial sector needs to be holistically addressed and be put in place for India to aim and achieve a growth rate of 8-9 per cent in the medium term horizon.

Taking world stage

Indian Prime Minister Narendra Modi after taking the helm last year has taken centre-stage globally. PM Modi has won many hearts of CEOs and the Indian diaspora whenever he travels abroad. This is indeed not surprising given his penchant for being extremely media savvy and wanting to raise India’s profile and visibility with the world’s leading nations, emerging countries in key regions and next-door neighbours. The bonhomie, energy and the passion on display aptly signifies the change in tone and tenor of India and its people. A country wanting to lead and not remain a developing country forever!

In the global economic landscape, India is one of the few bright spots in an otherwise gloomy global economic scenario. With its moderating inflation, strong currency reserves, lower current and fiscal deficit and stable tax policy, the prospects of Indian economy appear bright. India needs to sustain a high growth rate through massive investments in infrastructure and utilizing its human resources capital.

India’s New foreign trade policy

The new foreign trade policy announced the Indian Government in April this year attempts to bolster India’s bid to reach $900 billion of merchandise and services exports annually in five years.

This implies that the total two-way trade is expected to double from the present $1 trillion to $2 trillion annually in the next five years. This is a gigantic task considering that global economy is still struggling to gain momentum. The new policy considers two challenges – trade facilitation and ease of doing business, as major focus areas. Recently, the Government reduced the number of mandatory documents required for exports and imports to three, which is comparable with international benchmarks. A facility has been created now for uploading documents in exporter or importer profile and the exporters will not be required to submit documents repeatedly. Government has also made an attempt to simplify various forms, bringing in clarity in different provisions, removing ambiguities and enhancing electronic governance.

Challenge or an opportunity?

For India to succeed as a global manufacturing powerhouse, it has to first address two key challenges. It has a large infrastructural deficit and nearly

$1 trillion is estimated as the capital investment required to bring it up to the same level as many of its neighbours. India’s rankingin ease of doing businessneeds to be improved significantly to encourage prospective investors to come into India in a significant way.

A leaf from China

India in a way, is where China was in the 1990s, when they leapfrogged and built a world-class infrastructure. Those days, people in China and globally used to say, look at those massive roads and big flyovers in China. Are they really serving any purpose; do we need so many of them? Now, that is no longer sufficient. China anticipated growth patterns, boosted infrastructure, use it as an effective building block for growth and economic development.

Similarly, the development of various provinces in China resulted in a high growth trajectory. China’s successful foray into world markets is largely due to its strategy to engage across various sectors with different economies.

At the same time, the strength of the diaspora was also effectively leveraged.

Now look at India. The Indian PM Modi has set in motion a massive drive to upgrade India’s infrastructure and all avenues are being explored to fast track developments of roads, railways, ports, power generation, airports, etc. His reaching out to the Indian diaspora in USA, Europe and other Countries brings people closer and builds confidence for India.

In the wake of global turbulence and especially developments in China, Indian PM Modi is exploring how India can embrace more opportunities.

The International Monetary Fund considers India’s economy a rare bright spot among emerging markets and Modi sees a chance to attract more foreign investment as money flows out of China.

Leveraging“Make in India” program

PM Modi made a strong pitch in India and globally asked CEOs to invest in Indian manufacturing in a big way. He has promised setting up of special manufacturing zones to access the lucrative Indian market as well as produce for regional exports.Higher costs, currency challenges, non-availability of blue collar workers have been plaguing world manufacturing. Automation, relocation and consolidation of manufacturing operations is now underway worldwide. This gives India a unique chance to offer its large domestic market to attract those global companies who are relocating to South East Asia.

If the pull factor of Indian markets succeed, then India could see increased investments into its manufacturing sector that will also in turn produce dividends for its services sector.

The Indian manufacturing sector has the potential to create 90 million jobs over the next 10 years. During this period, the share of manufacturing sector could improve to 25% of GDP from the present 18% of GDP though the Make In India campaign that aims to transform India into a global manufacturing hub wherein MNCs could settle manufacturing base in India using the vast India’s talent and competitive human resources.

It’s Asia’s Century!

Asia has been steadily taking centre stage across the globe. Be it China, India, Singapore or ASEAN, the Asian market presents significant opportunities for the world and with a downturn in many developed economies, Asian Countries can gain enormously.

India’s ascension can help effectively realize complementarities with various production hubs of Asia and India’s Act East and Make in India programs would start to look realand can pay rich dividends for the region and the world.

No Comment