The Importance of Forex Trading Software in Modern Trading

In the fast-paced world of forex trading, having the right tools at your disposal is crucial for success. The forex market operates 24 hours a day, making it essential for traders to have software that can keep up with the relentless pace of trading. From real-time data analysis to automated trading systems, forex trading software https://exbroker-argentina.com/ offers various tools that can transform the way you approach trading. This article will delve into the various types of forex trading software, their features, and how you can leverage them to improve your trading outcomes.

Types of Forex Trading Software

Forex trading software can be categorized into several types, each serving unique functions that cater to different trading styles and strategies:

- Trading Platforms: These are the most common types of software used by forex traders. Platforms like MetaTrader 4 and MetaTrader 5 provide users with a comprehensive interface for executing trades, analyzing market conditions, and monitoring their accounts.

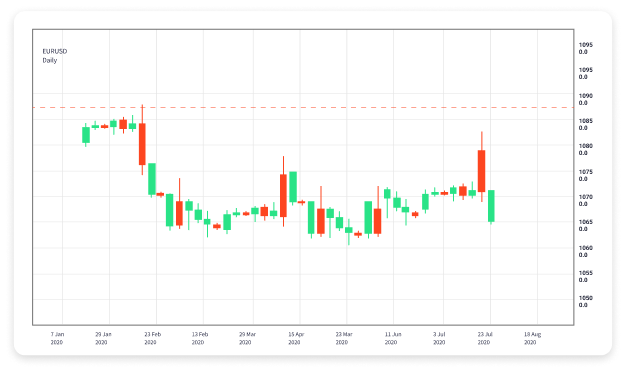

- Charting Software: This type of software focuses on providing in-depth technical analysis tools. Applications like TradingView allow traders to view price charts, apply indicators, and make informed trading decisions.

- Automated Trading Software: Also known as trading robots or Expert Advisors (EAs), these programs can analyze market conditions and execute trades on behalf of the trader. They can help eliminate human error and emotion from trading decisions.

- Risk Management Software: These tools are designed to assess and mitigate trading risks. Features may include position sizing calculators, stop-loss order settings, and portfolio risk analysis tools.

- Signal Services: These are software programs or services that provide traders with buy/sell signals based on specific market conditions and analysis methods.

Choosing the Right Forex Trading Software

Selecting the right software depends on various factors, including your trading style, expertise level, and personal preferences. Here are some tips to help you pick the best forex trading software for your needs:

- Define Your Trading Goals: Before selecting software, outline your trading goals and styles. Are you a day trader looking for quick trades, or a long-term trader focusing on trend analysis? Your goals will significantly influence the type of software you need.

- Look for User-Friendly Interfaces: A complicated interface can hurt your trading efficiency. Choose software with a straightforward layout and intuitive navigation so you can focus on trading rather than figuring out how to use the program.

- Ensure Compatibility: Many traders operate on multiple devices. Ensure your chosen software is compatible with various operating systems and devices so you can trade on the go.

- Evaluate Costs and Fees: While some platforms are free, others can come with hidden fees. Make sure you understand the cost structure of the software, including spread, commission, and any other charges.

- Assess Customer Support and Community: Good customer support can be crucial, especially if you face issues during trading. A strong community forum can also provide helpful advice and share successful strategies.

Features of Effective Forex Trading Software

When evaluating forex trading software, consider the following essential features that can enhance your trading experience:

- Real-Time Data: Access to live market data is a must. The quicker you receive information, the faster you can react to market changes.

- Advanced Charting Tools: Look for software that offers a range of technical analysis tools, indicators, and customizable charting options.

- Risk Management Features: Effective software should provide you with tools to set stop-loss orders, take-profit levels, and calculate position sizes based on your risk tolerance.

- Trade Automation: The ability to automate your trading strategies through EAs can save time and ensure you don’t miss trading opportunities.

- Mobile Capability: In today’s fast-paced environment, having access to your trading software on mobile devices is a necessity for monitoring and executing trades remotely.

Popular Forex Trading Software Options

Here are some of the most popular forex trading software solutions available today:

- MetaTrader 4 (MT4): This is perhaps the most widely used trading platform among forex traders. It features advanced charting capabilities, automated trading via EAs, and a wide range of technical indicators.

- MetaTrader 5 (MT5): The successor to MT4, offering more features, including additional timeframes, more order types, and built-in economic calendars.

- cTrader: Known for its clean interface and professional trading tools, cTrader is preferred by many advanced traders for its sophisticated analytical techniques.

- NinjaTrader: This platform focuses on futures and forex trading with powerful charting and analysis capabilities, suitable for both automated and manual trading.

- TradingView: A web-based platform popular for its social trading features and powerful charting tools, ideal for sharing ideas with other traders.

Conclusion

Forex trading software has become an indispensable part of the trading landscape. With the right software, traders can automate processes, perform in-depth analysis, and execute trades effectively. As the forex market continues to evolve, staying updated with the latest software and tools will be critical to achieving trading success. Take the time to research and select the software that aligns with your trading goals, and you could see significant improvements in your overall trading performance.

No Comment