The Impact of Forex News Trading on Currency Markets

Forex news trading offers a lucrative avenue for traders looking to capitalize on economic events that can move currency pairs significantly. In this overview, we will explore the fundamentals of forex news trading, strategies employed by traders, and the psychological aspects that come into play when making trading decisions. For more insights and resources on trading, visit forex news trading trading-jo.com.

Understanding Forex News Trading

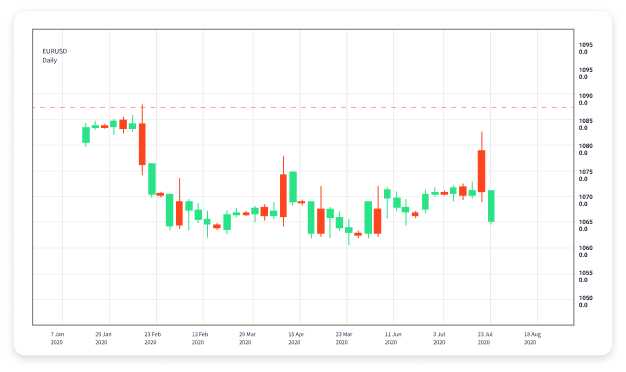

Forex news trading involves using economic news releases to make trading decisions. Traders analyze the expected impact of these releases on currency prices and aim to act swiftly when actual results deviate from expectations.

The Importance of Economic Indicators

Economic indicators serve as vital signals for traders. Some key indicators include:

- Gross Domestic Product (GDP): Measures the total economic output of a country, indicating its health.

- Non-Farm Payrolls (NFP): Measures employment in the U.S., a crucial factor for USD valuation.

- Inflation Rate: Typically measured by the Consumer Price Index (CPI), it affects the central bank’s monetary policy.

- Interest Rates: Announcements from central banks can lead to significant currency fluctuations.

Strategies for Successful News Trading

There are several strategies traders can employ when engaging in news trading:

1. Anticipation and Analysis

Traders often analyze forecasts from economists and financial analysts to anticipate how the actual news may impact the markets. This involves looking at consensus estimates and historic data to form a prediction.

2. News Trading Strategies

Some common strategies include:

- Straddle Strategy: Traders place both buy and sell orders around a news release to capture volatility.

- Fade the Move: Some traders bet against the initial market reaction, based on the idea that markets may overreact.

- Breakout Trading: When news leads to significant price movement, traders may enter positions to capitalize on the momentum.

3. Risk Management

Risk management is crucial in news trading. Since markets can react unpredictably, strategies should include stop-loss orders to minimize potential losses. Position sizing based on the trader’s overall risk tolerance is also important.

The Psychological Aspect of Forex News Trading

Understanding the psychology behind forex news trading can provide insights into market behavior:

Trader Psychology

Many traders succumb to emotional decision-making, often driven by fear and greed. During volatile news events, prices can fluctuate wildly, leading traders to make hasty decisions. Developing emotional discipline and a well-defined trading plan can help mitigate these challenges.

Market Sentiment

Market sentiment plays a critical role in how prices move following news releases. When the majority of traders believe a particular outcome will impact the market, their collective actions can create self-fulfilling prophecies. Thus, keeping an eye on market sentiment can be as important as analyzing the news itself.

Common Mistakes in News Trading

Even seasoned traders can make mistakes when trading on news. Some common pitfalls include:

- Lack of Preparation: Failing to analyze past news releases and market reactions can hinder decision-making.

- Ignoring Economic Calendars: Not keeping track of upcoming economic events can lead to missed opportunities.

- Inadequate Risk Assessment: Entering trades without proper risk management can result in significant losses during sudden market moves.

Conclusion

Forex news trading is a complex yet rewarding approach that requires a solid understanding of economic indicators, effective strategies, and emotional resilience. By arming oneself with knowledge and practicing disciplined trading, traders can navigate the fast-paced forex markets and capitalize on news events to enhance their trading results. For further resources and assistance in predicting the market, you can always check trading-jo.com.

No Comment